Trusted partners

Who we are working with

Why choose BCB Group

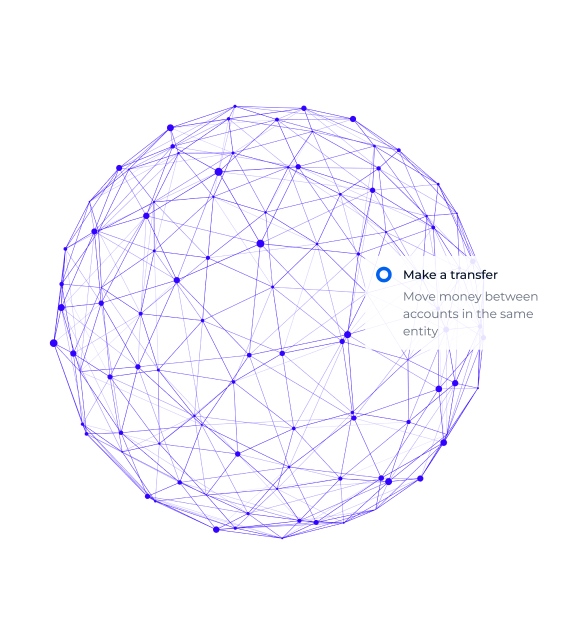

About usUnified Platform

Our all-in-one platform via UI and API allows you to view, manage, pay, store, earn and trade fiat, stablecoins and crypto, side by side through a single interface.

Regulated, reliable and robust

We continue to invest considerable time and resource into building our regulatory status in Europe and we are seeking additional regulatory approvals in other jurisdictions.

High-touch service

We provide clients with direct communication to our customer success, account management and trading teams.

-

Access e-money accounts which enable you to manage customer payments, trades and operating expenses across fiat, stablecoins and other cryptocurrencies – locally and globally.

-

Our BLINC network gives you access to 24/7 365-day fee-free settlement with any member of BCB Group’s ecosystem, which includes 100+ members across exchanges, market makers, traders, liquidity providers, brokers and funds.

-

Competitive pricing and best liquidity across major fiat, stablecoin and other cryptocurrencies, our market-leading spreads ensure you get the best possible pricing, with settlement in major currency pairs available on a same day, trade plus one or spot basis.

-

E-money Accounts

Access e-money accounts which enable you to manage customer payments, trades and operating expenses across fiat, stablecoins and other cryptocurrencies – locally and globally.

-

BLINC Instant Payments

Our BLINC network gives you access to 24/7 365-day fee-free settlement with any member of BCB Group’s ecosystem, which includes 100+ members across exchanges, market makers, traders, liquidity providers, brokers and funds.

-

Trading

Competitive pricing and best liquidity across major fiat, stablecoin and other cryptocurrencies, our market-leading spreads ensure you get the best possible pricing, with settlement in major currency pairs available on a same day, trade plus one or spot basis.