BCB Group - Guides - Best Indicators For Crypto Trading & Analysis

Best Indicators For Crypto Trading & Analysis

Cryptocurrencies trade 24 hours a day, seven days a week. This generates a vast amount of data, making it challenging to know what to look out for and how to cut through the noise. Indicators alongside candlestick charts offer traders tools to simplify data and recognise patterns to make better trading decisions.

BCB Group has its own in-house trading team providing regular insights into the market. This article will provide an overview of the most important indicators for crypto trading and how they can be used to facilitate trading decisions.

Reach out to our team to discuss how BCB Group can support your business.

What is a Trading Indicator in Crypto?

You may be wondering what trading indicators in crypto are. In simple terms, trading indicators are technical tools that use graphs and formulas to indicate which direction the market will go. They rely on using historical data to predict what the price of an asset will look like in the future. When using trading indicators, traders will look for repeating patterns and for confirmation of trends.

As their name suggests, trading indicators are not absolute. They merely point at a direction, but there is no guarantee that the price will always follow that indication. Particularly when trading in cryptocurrencies, and depending on the platform one is trading on (decentralised exchange or centralised exchange), aspects like slippage and liquidity will play into the assets movements.

First, it is important to differentiate between leading and lagging indicators.

Leading Indicators

Leading indicators use past price data to forecast future price movements. These types of indicators enable traders to predict how the price will move in the future and are a great tool to enter a trade at the start of a trend. However, sometimes, these indicators might show trends at the wrong time, fake breakouts, or signs of reversals that turn out to be just a small correction.

The benefits of leading indicators are that they offer favourable entry points and assist traders in chasing higher possibility trades by identifying key levels.

Lagging Indicators

Like leading indicators, lagging indicators rely on previous price data. They lag behind the market, meaning moves will only show up in the indicator after they happened. An example of a lagging indicator in macroeconomics is inflation.

The benefits of lagging indicators in crypto trading are that they allow traders to enter trades with greater conviction as they confirm price action and reduce the risk of falling for false breakouts. However, traders might miss good entry points as lagging indicators have no concept of key levels in the way that leading indicators do.

What are the Different Types of Trading Indicators to be Aware Of?

MACD

The first indicator is the Moving Average Convergence Divergence. To understand the lines it consists of, we will quickly explore moving averages.

Moving Averages

Moving averages are generally a reflection of an asset’s average price over time. When using a trading platform, traders can use the default moving averages provided or define their own. This will depend on the time horizons they are trading.

We further differentiate between simple moving averages and exponential moving averages. The simple moving average takes the arithmetic mean of prices over a time period, whereas an exponential moving average gives more weight to recent price movements.

Overall, moving averages in isolation are very simple and well-used indicators, enabling traders to confirm trends and identify key price levels. In MACD, two different moving averages are combined.

Gerald Appel invented the indicator in the 1960s. It helps calculate the direction, length, and strength of momentum. Since it relies on moving averages, it falls under the trend-following, lagging indicators.

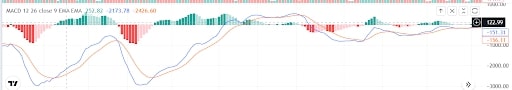

As can be seen above, the indicator consists of two lines: the MACD line and the signal. The MACD line is calculated by subtracting the 26-period (period refers to the intervals traders define on their trading chart) EMA (exponential moving average) from the 12-period EMA.

The signal line is simply the 9-period EMA. For instance, when a trader uses the indicator on a one-day chart, the MACD line would be 12-day EMA – 26-day EMA, whereas the signal line would be the exponential moving average of the last nine days.

The green and red bars in the indicator form the MACD histogram, which fluctuates above and below zero to help identify bullish and bearish momentum. It’s simply the difference between the MACD line – the signal line. If the MACD is above the signal line, the histogram is positive.

When the MACD is positive and the histogram is increasing, this is a sign of increasing momentum. Usually, the price grows in these cases generating a buy signal and vice versa.

Another way to use the MACD is to spot divergence. Divergence signals happen when the price is moving in one direction, but the MACD indicator is moving in the opposite. This can hint at a trend reversal. We distinguish between bullish divergence, where the prices make lower lows on the candlestick chart, but the MACD indicator instead creates higher lows. This means the trend is losing steam, and a new price rally might follow.

A bearish MACD divergence is an opposite scenario, with the price of an asset showing higher highs but MACD lines seeing lower highs.

Overall, MACD is a great tool, even for new traders, thanks to its simplicity and the pretty clear signals it sends.

RSI

The relative strength index (RSI) was created in 1978 by J Welles Wilder and has since gained popularity initially in stock trading and, in recent years, among cryptocurrency traders.

The indicator consists of 3 lines, with the one in the middle being the actual RSI indicator (yellow in the image). With the RSI, traders can estimate if an asset is overbought or oversold. The RSI goes from 0 to 100 and is calculated based on the 14 recent periods using the average of absolute upward or downward price changes.

When the RSI stands at 30, an asset is deemed to be oversold, whereas a value of 70 would indicate that it is overbought. If an asset is oversold according to the RSI, that means that it is trading at the upper third of its price range. Overall, RSI measures how strong up and down movements are and is a pretty clear indicator. All one has to do is watch out for key levels. However, there is no guarantee that assets will actually bounce once RSI hits 30 or 70. Generally, RSI signals are more potent when the market trades in a range without significant up or down movements. That’s because, in a market where the price is climbing, the RSI becomes unreliable as it has no way to predict the top.

Like MACD, one way to use the RSI is to look out for when it diverges from the broader market trend and indicates a change in price momentum before it is reflected in price action.

Bollinger Bands

Bollinger Bands were created by John Bollinger in the 1980s and have become very popular for their precision in highlighting volatility. As crypto assets are notoriously volatile, Bollinger Bands provide a great way to plot that volatility.

Bollinger Bands overlay the candlestick chart with three bands. The middle band is the moving average of usually 20 periods. The upper band is the value of the middle lines + 2* standard deviation of the price. The lower band is the value of the middle line minus 2* standard deviation.

The distance between the bands consequently depends on how volatile the price has been. If the price has been more volatile, the bands widen while narrowing when the markets are calmer. The price tends to return to the middle of the bands whenever it touches one of the outer bands. Traders can use this to short or long whenever the asset touches the outer bands, depending on the expected direction of the return. Bollinger Bands can even indicate if an asset is overbought or oversold when candles are outside the bands with extremely high or low points.

It’s generally better to use longer time frames for Bollinger Bands as very short time frames will often create false moves and noise.

OBV (On Balance Volume)

On Balance Volume is a volume indicator that uses trading volume to predict if a price will change. The first one to introduce it was Joseph Granville in 1963 when publishing a book on stock market trading.

The idea behind OBV is that the trading volume impacts the price and can serve as a powerful tool to decide if a trend will last or not. On top of that, OBV also offers clues as to what type of participants are trading in the market. For instance, if the volume increases and the price remains flat, it could imply that institutions or more sophisticated players are buying assets from retail traders only to then sell them back as soon as the price goes up.

The OBV is calculated by either adding or subtracting the current trading volume from the previous OBV. When the closing price of the day is higher than yesterday’s, then the volume is added and subtracted when it’s not.

Unlike for the RSI, numerical values aren’t important to generate signals with the OBV because it’s a momentum indicator. The slope and its direction provide more insight than the absolute value. Broadly speaking, when the volume on up days is outpacing the volume on down days, we can expect an asset to follow the move up eventually. The steeper the slope, the stronger the trend.

However, when using the OBV, traders should be wary that it can easily be thrown off by whales or market makers that generate high volumes without impact on the price. Just like other indicators, the OBV is best seen as a signal to be used in conjunction with Moving Averages and the above-mentioned indicators.

Conclusion

The aforementioned indicators together provide new traders with a solid set of tools to start making more informed decisions when trading the cryptocurrency markets. While there are no perfect indicators, combined use of them together with tools such as candlestick patterns may enhance the probability of making returns.

When trading, the last thing one wants to worry about is the ease at which to move into fiat again. That’s where BCB Group excels by providing leading exchanges and trading platforms with the infrastructure they need. Reach out to our team to learn more.

BCB Group comprises BCB Prime Services Ltd (UK), BCB Payments Ltd (UK), BCB Digital Ltd (UK) and BCB Prime Services (Switzerland) LLC. BCB Payments Ltd is regulated by the Financial Conduct Authority, no. 807377, under the Payment Services Regulations 2017 as an Authorised Payment Institution. BCB Prime Services (Switzerland) LLC, a company incorporated under the laws of the Swiss Confederation in the canton of Neuchâtel with business identification number CHE-415.135.958, is an SRO member of VQF, an officially recognized self-regulatory organization (SRO) according to the Swiss Anti-Money Laundering Act. This update: 14 Oct 2020.

The information contained in this document should not be relied upon by investors or any other persons to make financial decisions. It is gathered from various sources and should not be construed as guidance. The information contained herein is for informational purposes only and should not be construed as an offer, solicitation of an offer, or an inducement to buy or sell digital assets or any equivalents or any security or investment product of any kind either generally or in any jurisdiction where the offer or sale is not permitted. The views expressed in this document about the markets, market participants and/or digital assets accurately reflect the views of BCB Group. While opinions stated are honestly held, they are not guarantees, should not be relied on and are subject to change. The information or opinions provided should not be taken as specific advice on the merits of any investment decision. This document may contain statements about expected or anticipated future events and financial results that are forward-looking in nature and, as a result, are subject to certain risks and uncertainties, such as general economic, market and business conditions, new legislation and regulatory actions, competitive and general economic factors and conditions and the occurrence of unexpected events. Past performance of the digital asset markets or markets in their derivative instruments is not a viable indication of future performance with actual results possibly differing materially from those stated herein. We will not be responsible for any losses incurred by a client as a result of decisions made based on any information provided.