BCB Group - Guides - Centralised vs. Decentralised Exchanges

Centralised vs. Decentralised Exchanges

This article will provide a holistic overview of centralised and decentralised exchanges, their benefits and drawbacks, and how they differ. To conclude, we will share our thoughts on where we see the industry moving and what traders should consider before trading on either.

Reach out to our team to discuss how BCB Group supports digital asset businesses.

What is a Centralised Crypto Exchange?

Crypto exchanges are platforms that enable users to trade one cryptocurrency for another. Centralised exchanges (CEX) are crypto exchanges that act as intermediaries between buyers and sellers. They are called centralised because a company with centralised decision-making power runs them.

Trading on a CEX

Before a user can trade on a CEX, they must sign up and verify their account. If they own crypto, they can deposit to an exchange wallet which credits their account, ready for trading. If not, prospective traders can use fiat on-ramps to purchase crypto with credit cards, bank transfers, and more.

All trading on centralised exchanges happens through orderbooks. CEXs offer traders various order types, including limit orders and stop orders.

In order to offer competitive spreads, CEX place liquidity requirements for market makers on listed cryptocurrencies and tokens. CEX have sophisticated, high-speed matching engines that match users’ orders in milliseconds, facilitating a smooth experience, and minimising price swings during volatile market periods.

Advantages of a CEX

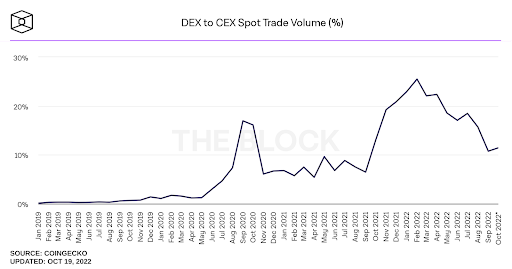

Source: The Block

Currently, more than 75% of trading volume is facilitated through CEX due to the ease of accessibility and the security and order management, making them a more robust choice for institutions with high volume requirements. Benefits of CEXs include:

- Fiat Support

Offer traders ways to purchase cryptocurrencies with local fiat currencies support off-ramps to fiat.

- High Liquidity and Volume

Thanks to market makers, and fast execution of trades, centralised exchanges have more liquid markets and offer institutions an attractive setting for their trades.

- Wide Variety of Supported Assets and Instruments

Centralised exchanges, as the authority validating transactions on their platform, can support various native cryptocurrencies, making it easy to trade cross currencies.

- User Experience and Support

Offer customer support including intuitive interfaces that help traders with any questions they may have.

Disadvantages of a CEX

Despite the advantages above, centralised exchange value also depends on the physical location of traders. Other disadvantages include:

- Requires Trust

When depositing into centralised exchanges, users give up custody of their cryptocurrencies removing the ability of traders to maintain ultimate control of their assets.

- Single Point of Failure

Like all centralised platforms, centralised exchanges are an attractive target for hackers. Sometimes, despite best efforts, CEXs get hacked. Earlier this year, for example, crypto.com lost $35 million.

- Lack of Transparency

Money flowing through centralised exchanges isn’t fully visible to the public. Sometimes, even when withdrawing, users will not receive their transaction hash until after receiving their transfer.

For those looking for an alternative to centralised exchanges, and traders wanting to dive deeper into the DeFi ecosystem, decentralised exchanges are the best place to start.

Decentralised Exchanges

Decentralised exchanges run as smart contracts on public blockchains like Ethereum or Solana. The first iterations of decentralised exchanges were based on orderbooks and the idea of facilitating trades between peers. This type of DEX is called an Orderbook DEX, where orderbooks can be hosted on-chain or off-chain. Off-chain orderbooks place reliance on third parties to manage orders, which prevents them from being truly decentralised.

On-chain orderbook DEXs have not yet become mainstream either, mainly because users quickly realised the lack of liquidity and the time it took for orders to fill.

DeFi and decentralised exchanges began to flourish with the introduction of Automated Market Maker algorithms by Uniswap.

Automated Market Makers (AMMs) and Liquidity Pools

AMMs have become the primary way traders can swap tokens in DEX. Instead of trading peer-to-peer, users trade peer-to-pool.

Automated Market Makers are algorithms that set the price of an asset based on a mathematical formula and the supply of tokens available in a DEXs liquidity pools.

Liquidity on DEXs is provided by users that add tokens to so-called liquidity pools and receive a share of transaction fees and sometimes airdrops of native tokens in return. The more tokens in a pool, the more liquid it is.

Because price is determined through a mathematical formula, it can deviate from the price that assets are trading outside of the pool. This phenomenon is referred to as impermanent loss and describes a situation where a user deposits tokens into a liquidity pool where they trade below market price.

Advantages of a DEX

There are a host of advantages DEXs offer with their innovative model of facilitating trading without intermediaries.

- Non-Custodial

On a DEX, users are in control of their funds at all times. They connect to a DEX with their crypto wallet and any transaction has to be signed and confirmed before it’s executed. This means users never give up custody, which aligns with the idea of crypto self-sovereignty.

- Permissionless

Anyone with an internet connection can access DEX. They do not discriminate by trader location.

- Transparency

When trading on a DEX, traders can audit all transactions. This offers a whole new level of insight into a tokens trading history and ways to measure success.

- Censorship Resistance

As decentralised protocols, no parties can censor transactions.

Disadvantages of a DEX

DEX trading volumes trail behind those of centralised exchanges. That’s because they come with a set of disadvantages that contribute to lower adoption.

- Impermanent Loss

While the ideal is for tokens in pools to eventually trade in tandem with overall market price, more often than not, impermanent loss can become permanent loss. Therefore liquidity providers are disincentivised from deploying their capital through DEX, reducing overall liquidity.

- User Experience

The processes for using decentralised exchanges can be less intuitive than those people are used to from TradFi. Depending on the underlying blockchain, trades may take longer to execute and can be expensive, further contributing to friction in user journeys.

- Token Support Limited

Since DEXs are built on-chain, they are limited to offering support for tokens that are native to the chain they run on. For example, Ethereum-based DEXs will support ERC-20 tokens, but a trader may not be able to swap from native Bitcoin to Ether easily.

- Hacks and Bugs

DEXs are only as secure as their code. If the code is badly written or contains bugs, they can be exploited.

Key Differences

Centralised and decentralised exchanges both exist to enable users to trade digital assets. They do so in very different ways, one by handling and verifying all transactions through centralised servers, while the other running as a permissionless smart contract.

Centralisation vs. Decentralisation

To conclude, both platforms have their benefits and downsides. There is no one approach that fits every need.

At BCB Group, we work with businesses across the blockchain and Fintech sectors that offer both centralised and decentralised services and products.

Reach out to our team to discuss how we enable leading exchanges to access to payment rails, and multi-currency transaction business solutions.

BCB Group comprises BCB Prime Services Ltd (UK), BCB Payments Ltd (UK), BCB Digital Ltd (UK) and BCB Prime Services (Switzerland) LLC. BCB Payments Ltd is regulated by the Financial Conduct Authority, no. 807377, under the Payment Services Regulations 2017 as an Authorised Payment Institution. BCB Prime Services (Switzerland) LLC, a company incorporated under the laws of the Swiss Confederation in the canton of Neuchâtel with business identification number CHE-415.135.958, is an SRO member of VQF, an officially recognized self-regulatory organization (SRO) according to the Swiss Anti-Money Laundering Act. This update: 14 Oct 2020.

The information contained in this document should not be relied upon by investors or any other persons to make financial decisions. It is gathered from various sources and should not be construed as guidance. The information contained herein is for informational purposes only and should not be construed as an offer, solicitation of an offer, or an inducement to buy or sell digital assets or any equivalents or any security or investment product of any kind either generally or in any jurisdiction where the offer or sale is not permitted. The views expressed in this document about the markets, market participants and/or digital assets accurately reflect the views of BCB Group. While opinions stated are honestly held, they are not guarantees, should not be relied on and are subject to change. The information or opinions provided should not be taken as specific advice on the merits of any investment decision. This document may contain statements about expected or anticipated future events and financial results that are forward-looking in nature and, as a result, are subject to certain risks and uncertainties, such as general economic, market and business conditions, new legislation and regulatory actions, competitive and general economic factors and conditions and the occurrence of unexpected events. Past performance of the digital asset markets or markets in their derivative instruments is not a viable indication of future performance with actual results possibly differing materially from those stated herein. We will not be responsible for any losses incurred by a client as a result of decisions made based on any information provided.