BCB Group - BCB Europe - Money20/20 Europe Fireside Chat: Interoperability – A Prerequisite for CeFi & DeFi Convergence

Money20/20 Europe Fireside Chat: Interoperability – A Prerequisite for CeFi & DeFi Convergence

We were delighted to host a fireside chat between our Chief Product Officer, Ashley Pope, and Ripple’s MD for UK & Europe, Cassie Craddock.

Read our article highlighting the key points and continue the discussion!

Why does interoperability hold such significance and what are the challenges for payment networks in today’s market and beyond?

Regulatory co-operation key to frictionless future

Global policymakers must foster closer collaboration for global market participants to benefit from the full potential from emerging technologies.

That was the warning from Cassie Craddock, Managing Director for UK and Europe at Ripple, in an engaging interview with Ashley Pope, BCB Group’s Chief Product Officer at Money 20/20 Europe on Tuesday 4th June.

Addressing delegates at the Amsterdam conference, Craddock said enhanced regulatory co-operation between major global regulatory centres would enhance the potential for true interoperability, benefitting all market participants.

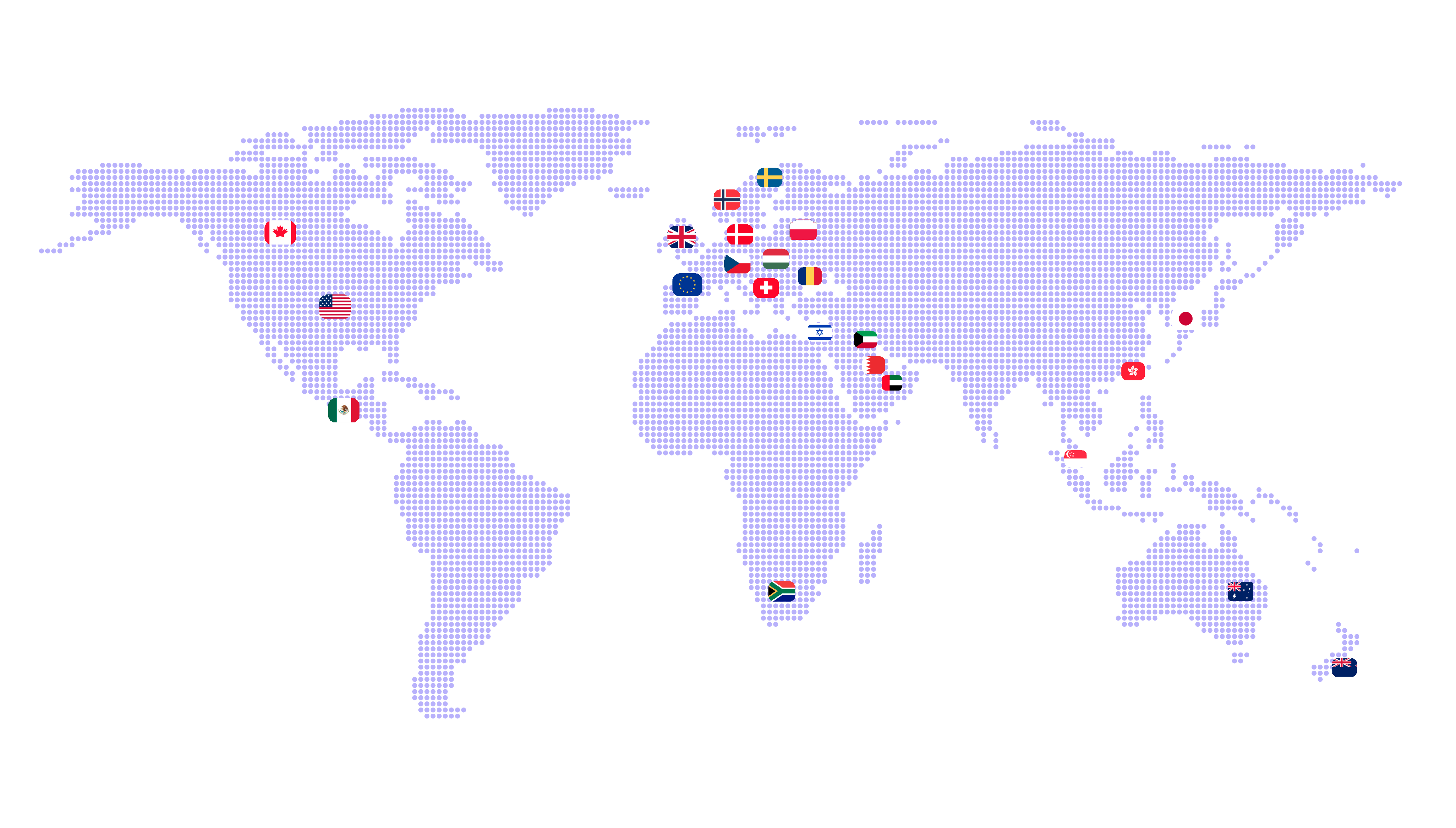

“From a regulatory perspective, we have seen progress in various markets with the introduction of the Markets in Crypto-Assets Regulation (MiCA) in Europe, the Virtual Assets and Related Activities Regulations (VARAR) in Dubai, and the Payment Services Act in Singapore.

“But these regulators have been working in silos and to create a global financial market, we need regulators to be working together to ensure that what one market is saying speaks to the other markets.”

BCB’s Pope said operating to the highest of regulatory standards can present challenges when trying to develop the very best solutions for clients.

“We are regulated in multiple locations,” he said. “What we have found is that individual jurisdictional licences enable locations to allow certain types of products and services, so you try to thread the needle through the licences you have, and perhaps leverage others from your industry partners.

“When we talk about complexity, it is important to remember that if a product doesn’t derive value for a client, it won’t be useable. That’s something we see as incredibly important.”

The theme of regulatory co-operation remains a hot topic for players in both the digital and traditional financial worlds as global regulators consider how best to set policy that will endure in a rapidly transforming marketplace.

In May, for example, the joint EU-UK Financial Regulatory Forum held their second meeting in Brussels to discuss the future of cross-border collaboration and policymaking approaches for the European Central Bank, European Supervisory Authorities, the Financial Conduct Authority and other European regulatory entities.

This came just days after BCB Group solidified its European presence by landing regulatory licences in France from the ACPR and AMF to be recognised as both an e-money institution and a digital asset services provider.

BCB’s Pope said it is important that policymakers recognise the benefits of seamless interoperability between different blockchains and financial systems, not least for those cultivating the future of payments, trading and settlement.

Delegates heard that the largest benefit of interoperability is increased financial access for all. But, within payments, it will also enhance efficiency, boost accessibility, promote innovation, foster enhanced security and enable cross border transactions.

In addition, the panellists explained that interoperability will further enhance regulatory compliance while potentially reducing costs and stimulating competition.

“Interoperability is the seamless exchange of data and functionality between two systems. It will pay a pivotal role in how successful blockchain technology is,” Craddock said.

“Right now, we have different systems that don’t talk to one another. From a customer perspective, it remains challenging to have data in different wallets or banks. Those systems don’t necessarily talk to one another and it is important that they do.”

The presenters explained the importance of being able to move assets seamlessly across different blockchains and platforms to facilitate deeper market liquidity and build confidence in the future market ecosystem.

“People want to build trading, lending and payment products in an ecosystem that has high liquidity,” Craddock added.

Delegates heard how banks and institutions were increasingly recognising the importance of interoperability, with market participants investing ever larger amounts into the development of their respective tokenisation propositions.

Research from Roland Berger forecasts that the total market value of tokenised assets could exceed US 10 trillion by 2030 while BCG estimates this number may be far greater at US 16 trillion.

“Banks and institutions are all looking at tokenisation as their first use case in the digital asset space,” Craddock explained. “The majority of customers that are leveraging our technology are using us for this.

“The reality is, that for that tokenisation ecosystem to thrive, we need to have a seamless exchange of assets across different blockchains.”

Panellists acknowledged the many challenges involved in moving to an interoperable environment, not least due to the technical complexity, cost and resistance to change from many of the incumbent institutions. Despite this, the mood of delegates at this year’s Money 20/20 event was undeniably positive for the future.