BCB Group - BCB Europe - Paris Blockchain Week Fireside Chat: BCB Group’s European Strategy Advances – Licences, Launches and Opportunities

Paris Blockchain Week Fireside Chat: BCB Group’s European Strategy Advances – Licences, Launches and Opportunities

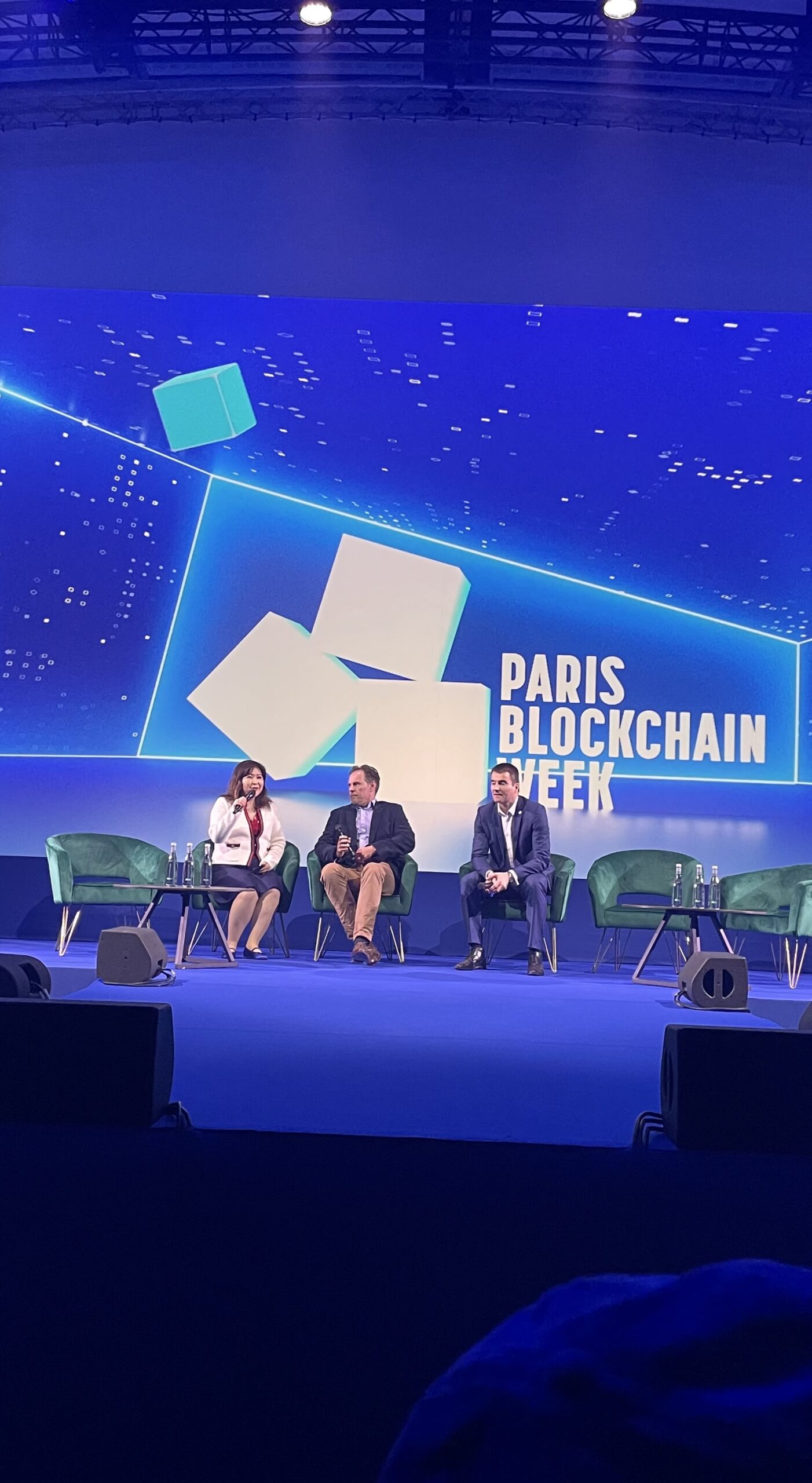

We were delighted to sit down with Sandra Ro, CEO at Global Blockchain Business Council (GBBC), the industry association for the blockchain and digital assets community, for a fireside chat on the main stage at Paris Blockchain Week.

Watch the replay below, read our article highlighting the key points and continue the discussion!

Going global with the highest regulatory standards

In the digital asset economy, regulated service providers find themselves at a pivotal moment. Changes to the regulatory framework are offering up opportunities for expansion and growth.

UK-based businesses are grappling with a shifting operating landscape due to significant policy and regulatory change. The Eurozone area is dealing with similar changes but offering more definite direction, thanks to the Markets in Crypto-Assets (MiCA) regulation.

MiCA is an EU-wide framework that offers clear definitions for crypto assets and specifies how cryptocurrency products and services should be regulated.

Speaking at Paris Blockchain Week in April, BCB Group’s CEO, Oliver Tonkin, and Managing Director, Jérôme Prigent, discussed the Group’s evolving European strategy. They were joined by Moderator Sandra Ro, CEO at Global Blockchain Business Council (GBBC), the industry association for the blockchain and digital assets community.

Understanding the European landscape

Founded seven years ago, BCB Group finds itself in a very different environment than when it first began. Little taxonomy around digital assets and cryptocurrencies existed, and the regulatory landscape had not started to take shape.

“When we started, everyone tried to shadow a regime that didn’t really exist. Now, there’s a lot more regulatory certainty, and the industry is in a good place because of that,” said Tonkin.

In 2024, one of the great strengths of the European Union is the possibilities it opens up, both from a regulatory and market access standpoint.

“Having a base within the EU unlocks access to all member states, opening up opportunities for us to expand into the region,” he said.

MiCA – which will fully come into force in December 2024 –will offer greater transparency and supervision for industry players and aims to unify digital asset taxonomies across the EU’s 27 member states.

Though the regulation is not yet perfectly formed, it is the most expansive regulatory framework available within the region, providing the certainty and confidence that customers crave, Tonkin explained.

Earlier this year, the French regulator, AMF, shifted its rules for digital asset service providers, now requiring enhanced registration requirements that align with MiCA.

Supporting BCB Group’s expansion

As BCB Group starts to expand its global footprint, it is to perform at the highest possible level of regulatory compliance in every market in which it operates. In Paris, the panellists outlined the organisation’s current and impending licences.

In the UK, BCB Payments Limited is an authorised payments institution regulated by the Financial Conduct Authority.

In Europe, it is awaiting approval as an Electronic Money Institution by the French Prudential Supervision and Resolution Authority (ACPR) and is registered as a Digital Asset Service Provider (DASP). BCB Markets (Switzerland) (which deals with the Group’s crypto exchange and custody services) is also a member of the VQF, a self-regulatory organisation recognised by the Swiss financial regulator FINMA.

The Group’s presence in Switzerland provides optionality in a market with a welcoming regulator, advanced systems, and strong market opportunities for credit institutions.

BCB Group’s imminent licence grant from the ACPR and the AMF to act as an E-Money Institution and Digital Assets Services Provider in France, as announced at Paris Blockchain Week, means with France as its regulatory base, the grant will unlock further opportunities for growth in the French and wider European market.

“The ACPR will effectively provide a passport to EU countries, allowing us to knock on their door with a French licence and ask to prove ourselves in their country” said Prigent.

The grant will also see BCB’s established regional connections and advancing regulatory footprint enable it to expand its institutional product offering within the EEA.

The Group has ambitions to further expand its regulatory licences and approvals. Looking further afield, BCB is considering Asia, the Middle East, and LATAM as potential markets for its service and aims to deepen its relationships with current and potential customers, Tonkin said.

Why France?

Expanding into Europe gives the Group huge potential to accelerate growth, amplify its offering, and compete with other industry players, said Prigent.

The choice of France as BCB Group’s European regulatory base is grounded within three clear principles, the panellists explained.

The first lies within the country’s proximity and access to BCB’s current and future client base. Europe’s dynamic and rich ecosystem offers a technological and digital culture that can be leveraged by the broader organisation.

The second centres on its core business model of trust and reliability. To create a strong business for the future, the Group has positioned itself within a credible and steady regulatory framework, with backing from the ACPR and AMF.

“While the ACPR is demanding, it is the marker of trust for clients and will help us build a strong business for the future,” said Prigent.

Thirdly, MiCA regulation is intended to reposition Europe as a leader within the digital assets landscape by offering greater protection to customers and investors, while ensuring financial stability and supporting the industry. The Group’s strategic positioning within this framework will aid its model of trust as the regulatory framework continues to evolve.

“The strength of France is that it has a combination of a government that has very proactively put their arms around the sector and a regulator that is very much on side. Other countries often talk the talk at the government level, but the rich engagement is a lot harder to access,” Tonkin added.

The selection of France as a base also allows the Group to capitalise on the country’s entrepreneurial business environment, welcoming new and diverse talent to the industry.

Strategic offerings

BCB’s imminent expansion into France acts as the entry gate for any business that wants to store, pay, and trade in Europe, said Prigent.

The Group offers business accounts for the entire digital asset economy, offering its clients to pay in and out in euros through the Instant SEPA payments system. The funds can be stored and secured within BCB’s payments entity or markets account.

Meanwhile, BCB’s own payments network, BLINC, allows members to pay each other instantly across multiple currencies, stablecoins, cryptocurrencies and digital assets.

Trading in over 25 currencies, BCB can provide effective support for its European customers, as well as those further afield who want to enter the European market.

The forthcoming grant and subsequent expansion into France will allow BCB Group to further expand its offering and promises to make it a “group to watch,” as noted by Ro.

This document is for marketing purposes only and its sole intention is to provide the reader with information on the services that BCB Group may provide to its clients. It does not constitute an offer and is not capable of acceptance as such. These services are only available to onboarded clients in good standing with BCB Group and their use of such services is subject to the applicable terms and conditions. These services may be provided by different BCB Group entities depending on the licensing requirements and scope. Respectively, the Services listed above may not be available in your jurisdiction of establishment. The terms and conditions applicable to the said services will indicate which entity of the BCB Group will provide the said services.