BCB Group - Insights - Q&A with Ashley Pope, Head of Product

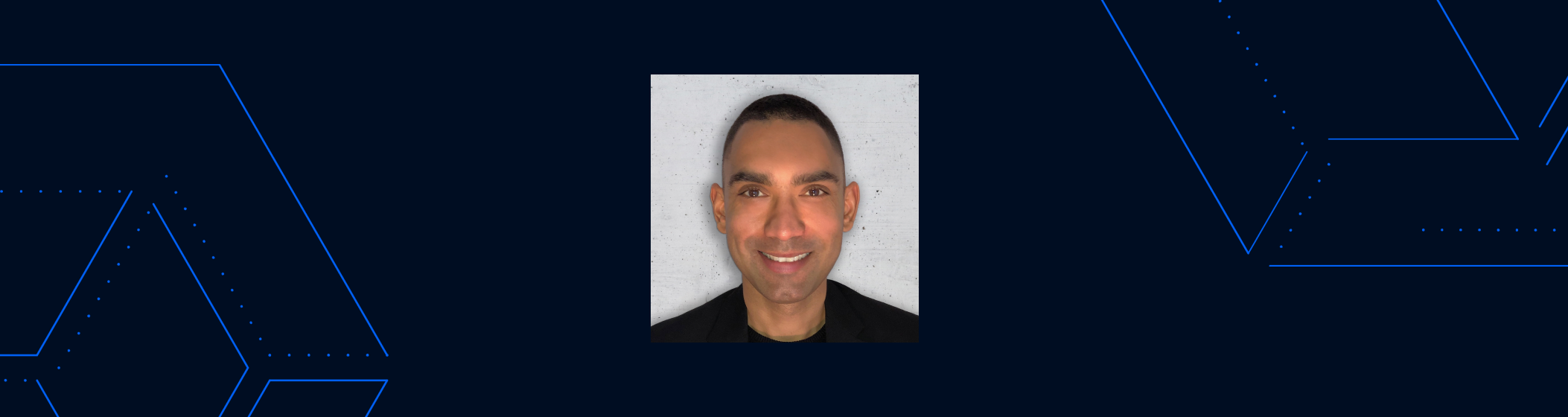

Q&A with Ashley Pope, Head of Product

We sat down with Ashley Pope, our Head of Product, to discuss his role, BCB Group and the challenges facing the crypto industry.

Q: Describe your job role at BCB Group.

Ashley: I’m Head of Product. I look after our fiat and crypto products that span the movement and exchange of any type of crypto and fiat value.

At BCB Group the clients we service include the big market makers, exchanges, crypto hedge funds, liquidity providers etc. and I’m here to make sure that their needs are met through the current products we offer, and also look forward into the future as to what they may need.

Q: What does a typical work day look like for you?

Ashley: First thing I always look at my instant messages to see what’s going on; check my emails, join the company morning call, and participate if anyone needs anything from the Product team. I then check in with the tech teams and my product team to take a look at the short, medium and long term deliverables.

I have an ongoing book of work and responsibility across different types of programmes including existing products, new products and cross functional deliverables and programmes. A large part of my role is to connect people together, create conversation, build consensus and move different programmes forward within the business. We’re always trying to work out how we can price better, monetise more effectively and develop more engaging products whilst also keeping an eye on the regulatory piece, because it’s important that as a product team we understand, especially in crypto and the finance space, what is possible from a regulatory point of view so we can then build and sell legally to our clients as we are a regulated business. I’m also regularly scanning the marketplace and looking at what competitors are doing and conducting deep dives into technical detail around new blockchain protocols.

Q: Why did you choose to go into this industry?

Ashley: I was in the music industry up until eight years ago. I switched from full time music into a new career after the financial crisis hit as many touring DJ’s and producers were greatly affected with a decrease in bookings. The financial crisis got me thinking about finance generally and I started looking into the system more and then eventually decided to go into it. My career path has been somewhat winding and varied. I got hired as a part time admin assistant during the financial crisis for a friend of mine who was a legal counsel for a multinational business. This developed into legal work assessing and negotiating software contracts. I then got into technical consultancy. I came across Bitcoin in 2011. At first, I thought it was a scam so I didn’t do anything about it but then around 2015 I started hearing more about Bitcoin. So I started looking into it again and thought about how it wipes the tables with existing global methods of value transfer and storage. The journey started from there and I started thinking about how crypto could be used to disintermediate the current system. I had a couple of startups and then got gainfully employed in a business that was building crypto platforms.

Q: What are the major themes that you’re seeing come out of the crypto industry at the moment from a product perspective?

Ashley: Privacy is one. Pretty much all-on-chain activity is pseudonymous and not anonymous, so it’s not completely private. If you’re relatively switched on, or pay a specialist firm, you can find out who the owner of crypto is or you can get a good idea of where the funds are flowing to and from. If you’re a business, your flows can be tracked relatively easily.

Tokenization is another major theme. There’s been a lot in the news around NFTs and their use to tokenize art, music or property rights that are then transferable, shareable and sendable, globally. Tokenization of more classically recognised securities is also an interesting area although more tricky as there isn’t really a global framework for the trading of tokenised securities quite yet.

Then there’s the lending and borrowing space in crypto, more commonly referred to in crypto as “DeFi”. When I look at the global nature of DeFi this is somewhat at cross purposes with local laws in many cases, as local regulators feel they have jurisdictional control over their particular geography, but DeFi markets are decentralised and global, so there’s a bit of a mismatch there at the moment.

Another important trend is identity, and the notion of a commonly, global usable and verifiable distributed identity, that doesn’t necessarily have to be viewable by participants in a system but can be relied upon in global trade without repeated verifications. This doesn’t exist right now but I think it’s really important to consider in light of the lack of privacy on public blockchains, global KYC standards and disjointed regulatory approaches. A globally accepted distributed identity can enable global financial service and product participation in a swift, compliant and private manner keeping both regulators and market participants happy!

Q: What do you think the biggest challenges facing the industry are right now and how do you think BCB Group is addressing those challenges?

Ashley: One of the biggest challenges offering products in crypto is around operating in a way that meets and exceeds the expectations of regulators whilst regulations remain immature. For instance the operation of crypto businesses is not under the same prudential obligation as traditional finance businesses. So for instance, the DASP licences and the VASP licences in Europe don’t have a prudential obligation. Whereas in the traditional finance world, rightly so you have to safeguard client funds.

As a firm we are regulated and safeguard all client funds. Applying a common approach to whatever we do across fiat, or crypto, is something that will make BCB really appealing to clients.

Our Chief Compliance Officer, Tash Powell, has spent a lot of time working on and continuously improving our compliance framework for our fiat business and we’re applying the same level of diligence to the crypto world. So when we go out to clients, we can say that our Group already operates in a regulated environment. We adhere to the highest standards of integrity and professionalism when meeting our clients needs and enhancing the wider market underpins everything we do. On this point we stand out.

Q: What is your favourite thing about working at BCB Group?

Ashley: Well, I would say the level of complexity. We are dealing with complex problems and it’s always challenging to try and come up with solutions to those complex problems. We also have quite an open flat structure which I think is really good as debate and inquisition is encouraged!

Q: If you had to describe BCB Group in one word, what would it be?

Ashley: Purposeful. We will fall over along the way but then we will pick ourselves back up again and keep going.

Q: What do you think makes BCB Group unique?

Ashley: BCB Group has such a wide diversity of people from different backgrounds, and different industries, different experiences and also different ages. We’re also straddling both the new and future financial worlds. All in all this makes BCB Group quite a unique place to work!

Q: What are your interests outside of BCB Group?

Ashley: Reading, walking, sports and spending time with my family!