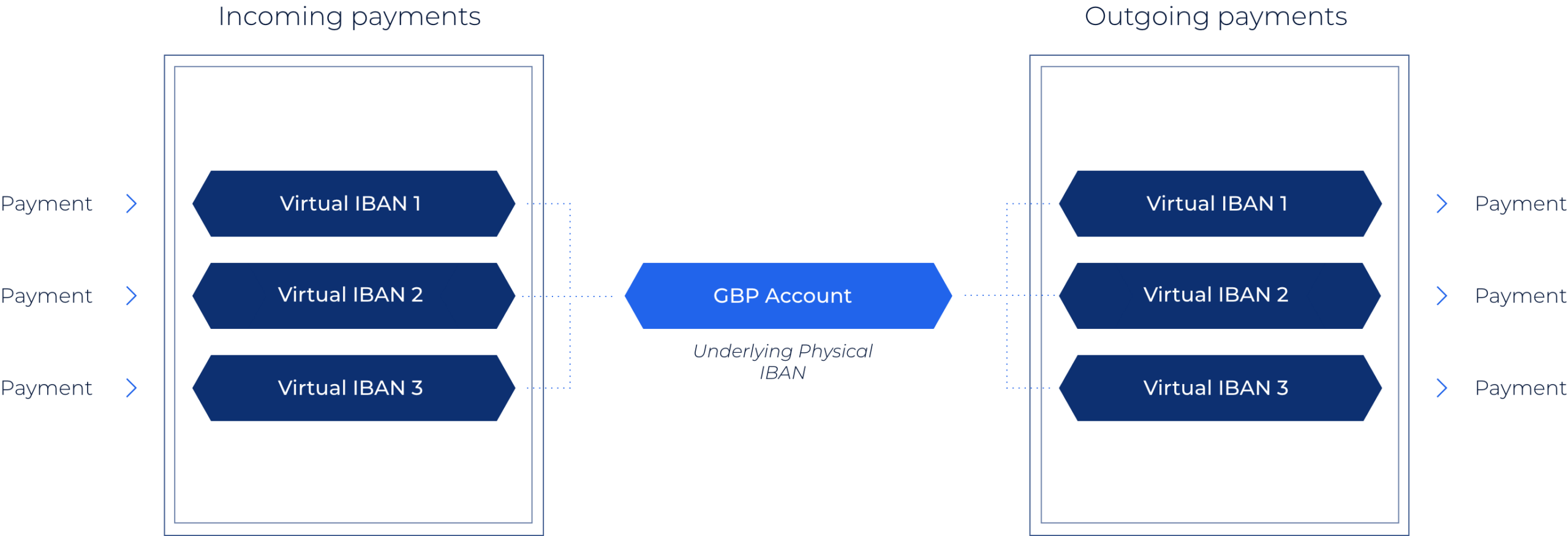

Our business accounts can now be partitioned into any

number of sub-accounts that you can label with your

clients’ names, identified individually by virtual IBANs, and

which roll up to your business account’s main IBAN.

Virtual IBANs remove the need for payment reference

numbers and enable you and your customers to send and

receive payments using universally recognisable account

details.

How it works

BENEFITS

- Allocate client money accurately, reducing payment rejection rates from error-prone payment references

- Remove manual reconciliation requirements

- Improve straight through processing rates and overall customer experience

- Decrease your customer time to value

- Improve Open Banking settlement to collect open banking payments and instantly issue payouts

RISK MANAGEMENT

- Enhanced security through account privacy and reduction of manual processing

- Reduce AML risk through clear segregation and improved transparency of resource funds

Extra Details

- The solution: 100% API integration based

- Capabilities: Create, assign, edit, close vIBANs

- vIBAN opening time: <10 seconds

- Number of vIBANs: Unlimited

- Currencies: GBP at first, the rest to follow

- TX Pricing: Volume based discounts